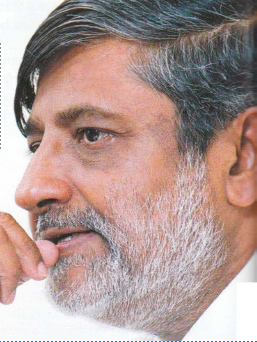

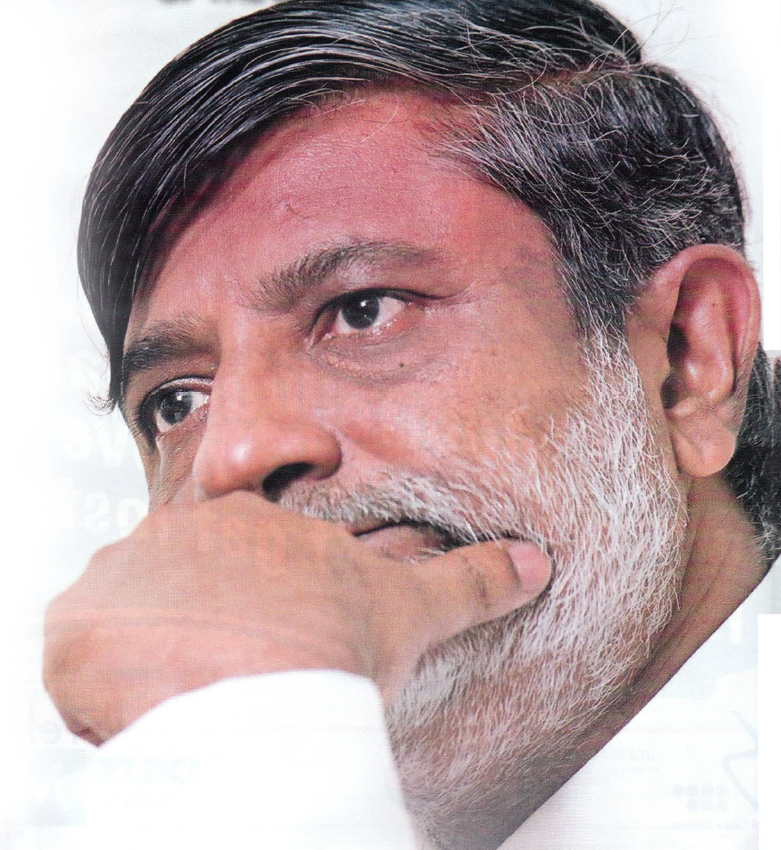

Tne People’s Leasing Company (PLC) is celebrating its 10th anniversary this year. D P Kumarage, the CEO of PLC, speaks to Anisha Niyas of Business

Today on what the company has achieved so far, how it plans to commemorate the anniversary, and why it is the success story of the leasing industry.

As People’s Leasing Bank celebrates 10 years of service, what are the highlights of the company’s story?

People’s Leasing Company (PLC) started in a small way as a private limited company. After five years we converted the PLC to a public company. Our performance has grown year by year in all aspects. All our financial indicators are quite sound. We started with a profit of Rs4m whereas this year we will have a profit of Rs615m, before tax. If we go by the number of employees – we started with three employees and we now have 380 – we also have the biggest leasing portfolio in the industry. We became the market leader in our seventh year of operation. From that point onwards for four consecutive years we have retained our market leadership.

How would you assess the company’s profit growth in the past 10 years?

Taking the leasing industry as a whole, the industry has grown over the last four years. This is the only industry in the financial sector that has grown to this level. PLC has grown a lot faster. The industry has grown to about 30 to 40% whereas there are years we have grown one hundred percent. Last year’s (2004/05) growth was 40% before taxation There are 68 players in the industry, accumulated over the past few years. At least five companies have been attracted to the industry in the past three years alone. Moreover, banks are also involved now. The current players in the market, which includes commercial banks and development banks, have taken an active role within the industry. So the competition within the industry is very severe. The World Leasing Year book ranks top 50 countries in order of disbursements. In 2005 Sri Lanka became the 46th country with regards to disbursements. That itself shows how the national leasing industry has grown.

What have been your main achievements?

We were the market leader in the leasing industry for the last four consecutive years. Becoming the market leader is good, but retaining that position is very difficult. We are competing with companies that have been operating for at least three decades. We have become number one despite the fact that some of the dominant players we compete with are quoted on the stock exchange. PLC also has the highest portfolio in the industry. Our portfolio, which has the lowest non-performing, has been rated by Fitch Ratings. They rated us ‘A’ three years back for an instrument that we issued to raise funds from the market. This was a big achievement for us. We have contributed immensely to the development of the country, especially in the transport sector. We have put in 5,000 Omni buses to the transport sector. This itself creates direct employment of at least four people per bus. If you take the private sector buses, we have had a monopoly in that area. Even today, the government states that it is the private sector that largely caters to the transport sector, for which we can claim credit that we have made a substantial contribution. For the first time, we managed to get the position as a Participatory Financial Institution (PFI) from the Central Bank under the Susahana Re-finance Loan Scheme. Outside the banks we were the best performers in that credit line. We are raising money from the market, and all top banks including HSBC and Deutsch Bank, have financed us. That show the recognition we have in this industry, especially in the finance market. We are the biggest borrowers in the markets. We have been borrowing for the last six to seven years and have been up to date with our debt servicing obligations. There have been banks that have gone to the extent of lending Rsl,000m to us. We have earned a very good name in the leasing industry. PLC was awarded the runner-up position twice of the leasing sector in the Best Annual Report Awards conducted by the Institute of Chartered Accountants of Sri Lanka (ICASL). That was a big recognition for us.

As People’s Leasing Bank celebrates 10 years of service, what are the highlights of the company’s story?

People’s Leasing Company (PLC) started in a small way as a private limited company. After five years we converted the PLC to a public company. Our performance has grown year by year in all aspects. All our financial indicators are quite sound. We started with a profit of Rs4m whereas this year we will have a profit of Rs615m, before tax. If we go by the number of employees – we started with three employees and we now have 380 – we also have the biggest leasing portfolio in the industry. We became the market leader in our seventh year of operation. From that point onwards for four consecutive years we have retained our market leadership.

How would you assess the company’s profit growth in the past 10 years?

Taking the leasing industry as a whole, the industry has grown over the last four years. This is the only industry in the financial sector that has grown to this level. PLC has grown a lot faster. The industry has grown to about 30 to 40% whereas there are years we have grown one hundred percent. Last year’s (2004/05) growth was 40% before taxation There are 68 players in the industry, accumulated over the past few years. At least five companies have been attracted to the industry in the past three years alone. Moreover, banks are also involved now. The current players in the market, which includes commercial banks and development banks, have taken an active role within the industry. So the competition within the industry is very severe. The World Leasing Year book ranks top 50 countries in order of disbursements. In 2005 Sri Lanka became the 46th country with regards to disbursements. That itself shows how the national leasing industry has grown.

What have been your main achievements?

We were the market leader in the leasing industry for the last four consecutive years. Becoming the market leader is good, but retaining that position is very difficult. We are competing with companies that have been operating for at least three decades. We have become number one despite the fact that some of the dominant players we compete with are quoted on the stock exchange. PLC also has the highest portfolio in the industry. Our portfolio, which has the lowest non-performing, has been rated by Fitch Ratings. They rated us ‘A’ three years back for an instrument that we issued to raise funds from the market. This was a big achievement for us. We have contributed immensely to the development of the country, especially in the transport sector. We have put in 5,000 Omni buses to the transport sector. This itself creates direct employment of at least four people per bus. If you take the private sector buses, we have had a monopoly in that area. Even today, the government states that it is the private sector that largely caters to the transport sector, for which we can claim credit that we have made a substantial contribution. For the first time, we managed to get the position as a Participatory Financial Institution (PFI) from the Central Bank under the Susahana Re-finance Loan Scheme. Outside the banks we were the best performers in that credit line. We are raising money from the market, and all top banks including HSBC and Deutsch Bank, have financed us. That show the recognition we have in this industry, especially in the finance market. We are the biggest borrowers in the markets. We have been borrowing for the last six to seven years and have been up to date with our debt servicing obligations. There have been banks that have gone to the extent of lending Rsl,000m to us. We have earned a very good name in the leasing industry. PLC was awarded the runner-up position twice of the leasing sector in the Best Annual Report Awards conducted by the Institute of Chartered Accountants of Sri Lanka (ICASL). That was a big recognition for us.

Tell us more about your leasing portfolio?

Our leasing portfolio is the best in the industry- the lowest non-performing contracts have been attributed to our company. That factor has been analysed by Fitch Ratings as well. Our basic raw material component is money. We generate our funds from the market and to raise money we mortgage the ‘future lease receivable’ as a security. We have almost Rs8bn of our portfolio being pledged to financial lenders. This is an indicator that the portfolio is qualitatively sound, otherwise other lending institutions would not accept it. Also our portfolio is very well diversified. We have corporate customers as well SME customers. We are very strong in that aspect. We can cater to any segment. Our staff is geared towards that.

What is your market share?

We retained about 15% of the market share in the leasing industry.

What is your policy on diversification?

We have kept on diversifying-that has been our forte in the industry. We aim to find a niche market. We ,,·ant to move away from the com·entional market and find a le competitive one. Islamic leasing i not a common thing in Sri Lanka. We are trying to move into that area and have gone a long way in forming that unit. In addition we have got a few credit lines from the Central Bank of Sri Lanka and the Asian Development Bank.

What is the profit outlook for 2005/2006 for PLC?

For 2006, we are expecting a profit of Rs620m net, prior to tax with a growth path of 98%. This is compared to Rs4.6m profit in 1997. This shows our growth. Our growth percentage last year was 18% in relation to disbursement and 40% in relation to profit.

What sort of growth potential does the leasing industry have in Sri Lanka?

This is the only industry in the financial sector that has done well over a period of time. In 2003/2004 the industry grew over 100%. We expect the industry to grow further.

How is PLC planning to commemorate this 10th anniversary?

Today companies are judged not only by performance of the bottom line. A company’s contribution towards society and towards the upliftment of the economy is equally important. We have understood that aspect of it. So to commemorate 10 years of service we have undertaken 10 Corporate Social Responsibility (CSR) projects. We have spent Rs15m on those CSR projects alone. We plan on completing the projects by the 31 May 2006, which we have set as the date of our anniversary. We have asked individual branches to identify a particular project. There are certain projects that are connected to education, health, community development and the environment. In this anniversary month of May, we plan on planting 1,500 fruit trees and 1,500 large trees such as teak and mahogany. Our branch network has stocks of trees, which we offer free to our customers. We have two credit lines in regard to second perennial crops. Through these credit lines we expect to go to the grass root levels and help people, especially in the agricultural sector. Our aim is not to make a huge profit. We are committed to uplifting such people because they are really poor. We want to bring them to a better living standard. We are trying to complete the perennial crop project by the end of this year.

“We were the market leader in the leasing industry for the last four consecutive years. Becoming the market leader is good, but retaining that position is very difficult.”

Why weren’t programmes such as these implemented before as part of the company’s CSR?

We didn’t do charity without the company being financially strong. Now that we are financially strong we can take up any of these matters. We have a duty as a corporate body to serve the people and uplift the economy of the country. This is one of the aims of the company from this year onwards.

What factors have contributed to your success?

Our financial statements are very strong, especially our balance sheet. We have big provisions that none of the other leasing companies have. We have a General Provision of Rsl,400 m, which is considered to be the highest in the industry. Since we have grown fairly fast over the years we did not want to be complacent. We wanted to play safe and build up that provision. This will enhance the value of the company. We have always looked at what the customer requires. We didn’t have a product as such but we have always maintained that we will give whatever product the customer wants. We have that flexibility. PLC has been able to structure a lease according to the requirements of the customer. These are the factors that have contributed to our success. The most difficult thing is not being the best but retaining that position for four consecutive years. We could not have come this far without the support of People’s Bank, of which we are a subsidiary. The Bank has played a pivotal role in our growth as a leasing company. We are in this position because we have capitalised on the strength of the People’s Bank, and coupled that with our private sector dynamism. We also have a lot of repeat bu iness. This means that the customers are happy, otherwise if they are not happy with the service we prO\ide they will go elsewhere. The customers that were with us when the company started are still with us. About 40% to 50% of our disbursements are from repeat customers. We have an open door policy at our company. Any customer can walk in to our office and meet with our executives. We are known as a people friendly leasing company.

What about the application of technology to the leasing industry?

We have a locally developed system and have 19 branches with the inclusion of the city office. We are technologically very advanced. All our branches are connected – a customer can pay in at any branch regardless of where their account originates. All related documents are system generated. We also have a very good Management Information System which is also system generated as well.

What are the future strategic plans for the People’s Leasing Company?

We want to increase our branch network by adding three or four more branches. We are also trying to move away from the routine market by ha,ing an Islamic leasing unit. So far there are no proper leasing companies addressing that sector. We plan on doing this in a big way. We have got the necessary approval and have already started it. There is no competition for this product and there is also tremendous potential.

“We have always maintained that we will give whatever product the customer wants. We have that flexibility.”